Safety stock is a buffer against supply chain uncertainty, so you can meet customer demand even when things go haywire. This calculation helps investors track how much is still owed to shareholders after dividends are declared but before they’re paid out. Suppose a company’s cash flow statement shows USD 3 million listed under dividends paid in the financing activities section. This means the company has paid USD 3 million to its shareholders during the reporting period. Retained earnings are the portion of a company’s profits that are not distributed as dividends but instead reinvested in the business.

What Are Dividends?

It is calculated by dividing the company’s P/E ratio by its expected rate of earnings growth. While many investors use a company’s projected rate of growth over the upcoming five years, you can use a projected growth rate for any duration of time. Using growth rate projections for shorter periods of time increases the reliability of the resulting PEG ratio. When you own a share of common stock, it means you own a little part of that company. This ownership gives you the right to vote on important company decisions and sometimes get a share of the company’s profits, which are called dividends.

Preferred Stock vs. Common Stock

For many, dividends offer not just a regular payout but also a way to understand the financial health and strategy of the companies they invest in. CFDs and forex (FX) are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading understanding cash flow statement vs income statement CFDs with this provider. You should consider whether you understand how CFDs, FX, or any of our other products work and whether you can afford to take the high risk of losing your money. First, determine the preferred stock’s annual dividend payment by multiplying the dividend rate by its par value.

Is there any other context you can provide?

Dividend yield helps investors compare different dividend-paying stocks and assess whether the stock provides sufficient income relative to its price. A high dividend yield might appeal to income-focused investors, but it’s essential to evaluate it in the context of the company’s overall financial health. If a similar situation occurs with any preferred stocks you own, here’s how to calculate the cumulative dividends owed to you.

Fixed Income Outlook: Bonds Hit Reset. A New Equilibrium Emerges

- Ultimately, most positions in the investing industry will likely interact with common stocks one way or another.

- This information is also maintained in the corporate secretary’s records, which are separate from the corporation’s accounting records.

- For example, if you operate in a sector with high demand variability, your safety stock levels will need to be higher to accommodate potential spikes in sales.

- This preparedness makes your business more resilient to supply chain uncertainties.

- In our modeling exercise, we’ll forecast the shareholders’ equity balance of a hypothetical company for fiscal years 2021 and 2022.

- Here we will guide you regarding common stock and provide you the tips on how to calculate common stock, but before that, we should know some basic information about stocks.

If you run out of stock, it will hurt your business, losing your sales and revenue. For example, imagine running a retail store, and suddenly, you run out of stock for a popular item just before a holiday sale because there was higher pre-holiday demand. This could mean lost revenue and frustrated customers who may choose to shop elsewhere.

However, with any financial metric, it’s important to see how a company compares to its peers. Walmart has a significantly higher PEG ratio than the overall supermarket industry average of 1.79. You can connect with a licensed CPA or EA who can file your business tax returns. We believe everyone should be able to make financial decisions with confidence. This difference between a low-risk expected rate of return (such as the T-Bill rate) and the higher expected rate of return that comes from increased risk is often referred to as the risk premium. Current liabilities are debts typically due for repayment within one year, including accounts payable and taxes payable.

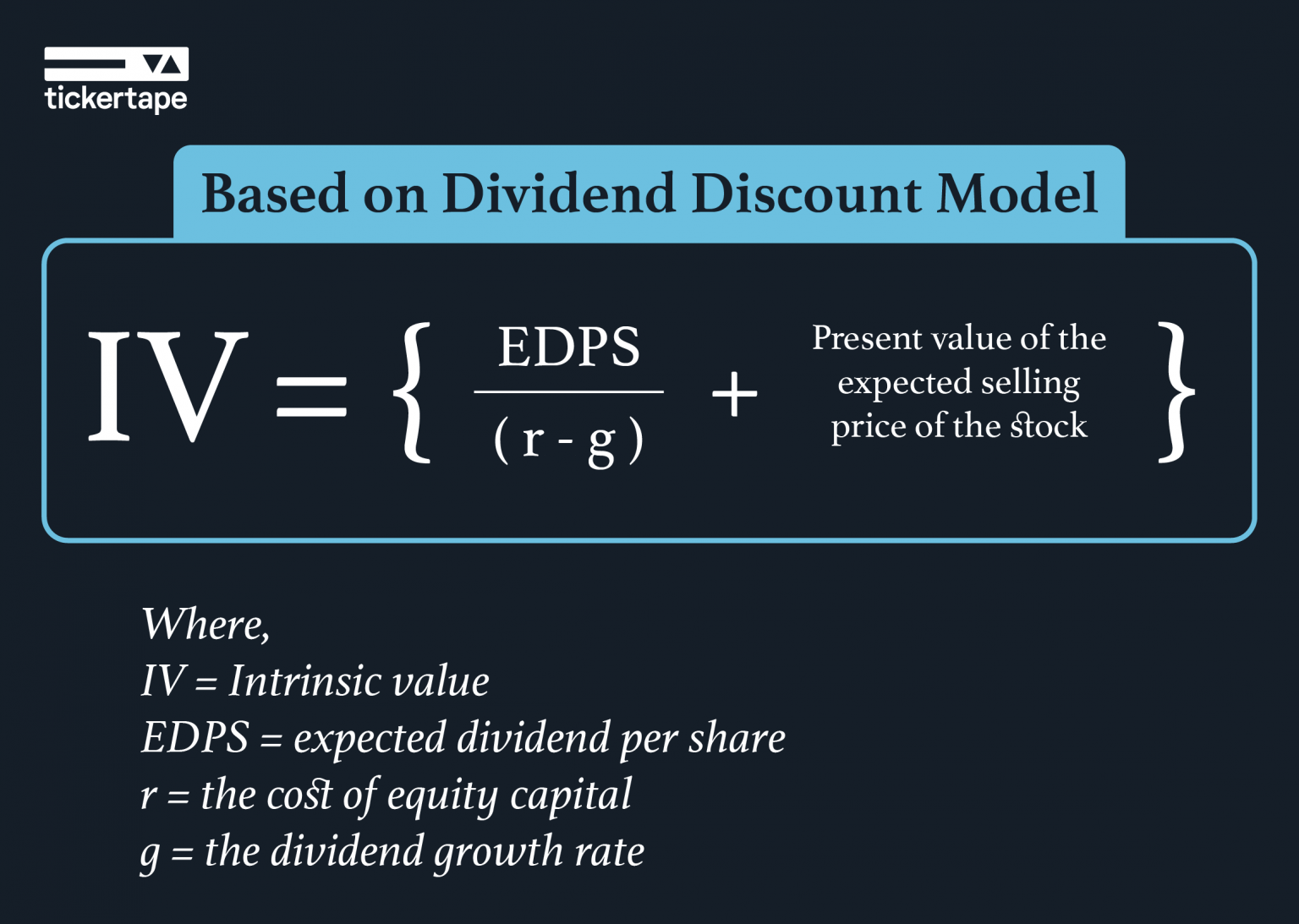

Investors and analysts look to several different ratios to determine the financial company. This shows how well management uses the equity from company investors to earn a profit. Part of the ROE ratio is the stockholders’ equity, which is the total amount of a company’s total assets and liabilities that appear on its balance sheet. The Dividend Discount Model (DDM) is instrumental in common stock valuation, especially for investors interested in predictable income streams from dividends. The primary distinction between preferred and common stock is that common stock grants stockholders voting rights, while preferred stock does not.

If you succeed in keeping this figure above the reorder point, you can prevent running out of stock and maintain seamless operations. For example, if your reorder point is 500 units, the software can alert you when your net inventory approaches this threshold, prompting timely reordering and avoiding potential stockouts. You can analyze your historical sales data and your supplier performance so you can have an accurate forecast of future demand and adjust your safety stock accordingly. So, you must ensure that you find the right balance between both larger and smaller amounts of stocks for safety.

Investors contribute their share of paid-in capital as stockholders, which is the basic source of total stockholders’ equity. The amount of paid-in capital from an investor is a factor in determining his/her ownership percentage. The equity capital/stockholders’ equity can also be viewed as a company’s net assets. You can calculate this by subtracting the total assets from the total liabilities. After the repurchase of the shares, ownership of the company’s equity returns to the issuer, which reduces the total outstanding share count (and net dilution). The formula to calculate shareholders equity is equal to the difference between total assets and total liabilities.

Owning stock in a company generally confers to the stock owner both corporate voting rights and income from any dividends paid. Each slice represents a share owned by investors, called common stockholders. Owning a slice means owning a part of the company, including rights to vote and earn dividends. It simply represents the amount of value due to common stockholders divided by the number of outstanding common shares. The call price of preferred stock is the amount paid to buy out preferred stockholders.

So, in this case, the number of shares issued is equal to the company’s outstanding shares. Companies sometimes buy back shares, which is part of their corporate strategy. If the company buys back its shares, that portion of the share is with the company, and the equity owners do not own that share. A single share of a company represents a small ownership stake in the business. As a stockholder, your percentage of ownership of the company is determined by dividing the number of shares you own by the total number of shares outstanding and then multiplying that amount by 100.